how fast does an auto loan build credit

In short buying a car can be a good way to build your credit score over the life of the loan but its more of a long-term credit building strategy. Specializes in bad credit no credit bankruptcy and repossession.

How To Pay Off Car Loan Faster Paying Off Car Loan Refinance Car Car Loans

How much your credit score will increase is determined by your starting point.

. Use these seven strategies to quickly build a rock-solid credit score. A car loan can raise your credit score but its a slow build accomplished through months and years of on-time payments while keeping up with your other bills. The next step in building business credit is opening.

Ad Credit Strong is the reliable way to build credit grow savings. Getting a new car loan has two predictable effects on your credit. If you make timely payments an auto loan will help you build your credit if the lender reports your payments to one or more of the three major credit bureaus Experian Equifax and TransUnion.

Here are some tips to consider if you need a credit builder. Provide your estimated credit score monthly income and monthly recurring debt and youll immediately get an estimated loan approval amount. Therefore youre going to want to plan out your purchase to make sure you dont overextend yourself and your payments fit well within your budget.

Auto financing also adds to your credit mix and new credit. Op 7 yr. October 10 2018.

Dont let a car dealership rope you into one of their financing deals they usually come out more expensive and with higher APR. It adds a hard inquiry to your credit report which might temporarily shave a few points off your score. After receiving full approval from your lender you can generally expect to receive your funds within one to three business days.

If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850. Okay heres where we can make the get-a-car-loan argument. For example if you have a thin credit file meaning you only have a few credit accounts a car loan will add to the number of accounts you have helping to build your credit history.

Network of dealer partners has closed 1 billion in bad credit auto loans. Some auto lenders often called Buy Here Pay Here lenders may not report your loan at all. A car loan by itself wont always build credit.

A car loan also helps to improve your credit mix by diversifying the types of credit you have. However you can use the car loan to help increase your score. You should go into the lot with a bank or credit union financing already.

In this article well answer the question Does financing a car build credit and provide some additional. Car loans credit cards within 6-12 months of applying for a mortgage. But if you have a low credit score like in the 400s making.

Refinancing a car has a. For instance you got a 0 financing deal. The turnaround time for full approval differs as our table shows.

If you make payments on time your credit score will grow. This affects 10 percent of your score. Open Accounts With Vendors That Report Payment History.

Ad A Loan for Almost Anything. When you open a new car loan that average will drop to about 15 years still well over a decade. Ultimately a car loan does not build credit.

Having both revolving credit such as credit cards that allow you. However you might have to wait up to 30 days to receive your D-U-N-S number. Avoid applying for credit eg.

Choose from 8 different plans starting at 15mo. When you take out an auto loan especially a bad credit car loan you gain the opportunity to make a positive impact on your credit by making all your monthly payments on time and in full. The best way to make sure you get the most impact in this area is.

But if youre new to credit and only have two credit cards that you opened a year ago and you get an auto loan the average length of your accounts drops in half from one year to six months. An auto loan will NOT impact your credit utilization. Buying a car does help your credit but never buy a car just to raise your credit.

To build a credit score from scratch you first need to use credit such as by opening and using a credit card or paying back a loan. On-time payment history is the most important factor when building credit. There can be an upside to keeping your car loan payment.

Some of these dealers may market themselves as a way. Pay All Your Bills On Time. Yes car loans help build credit.

Applying for a car loan can hurt you if youre getting a mortgage soon. The main reason a car loan is a good way to build and improve your credit score is because as you make payments on time you begin to build a positive payment history. A car loan has two common effects on.

It will take about six months of credit activity to establish enough history for a FICO credit score which is. So paying it off early wouldnt save you money but youll continue to benefit from having on. Ad Fast Application Low Rates Quick Decisions Start Today.

Payment history makes up 35 percent of your FICO credit score which is the score most commonly used by lenders. Check Your Rate in 5 Min Wont Affect Your Credit Score. The biggest piece of the pie is payment history making up 35 percent of your credit score.

Types of Credit in Use. But if you keep up with your monthly payments an auto loan can definitely help you improve your credit over time.

Need Car Loans For People With Bad Credit Apply Now For Auto Loan For Bad Credit History And Buy Your Drea Bad Credit Car Loan Loans For Bad Credit Bad Credit

Award Winning Credit Union Advertising Marketing Case Study Mdg Advertising Car Loans Banks Ads Car Loan Ad

17 Bad Credit Car Loans 2022 Badcredit Org

Free Car Loan Application Form Bad Credit Car Loan Best Payday Loans Payday Loans

What Credit Score Is Needed To Buy A Car Lendingtree

The Car Loan Site That 39 S Shaking Up The Industry Bad Credit No Credit Bankruptcy Loans Starting At 5 000 Amp Car Loans Bad Credit Car Loan Bad Credit

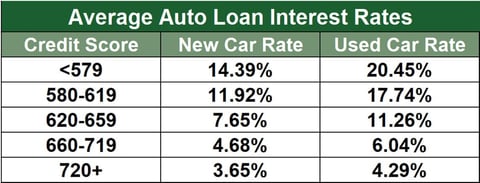

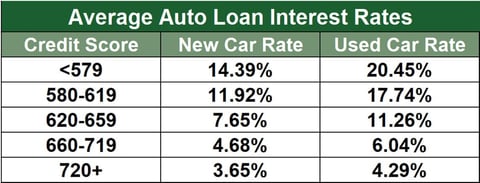

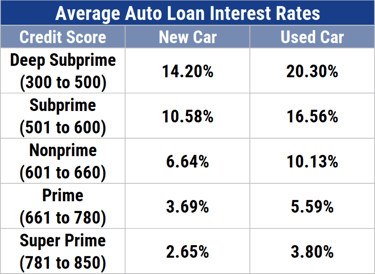

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

13 Instant Approval Auto Loans For Bad Credit 2022

Free Car Loan Application Form Car Loans Bad Credit Score Car Finance

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Saving Strategies

Does Financing A Car Build Credit

How To Get A Car Loan With No Credit History Lendingtree

Do I Qualify For Car Loan Car Loans Car Finance Loans For Bad Credit

Carloanasap Provides Online Auto Loan Services Regardless Of Any Credit Situation It Also Provides All Kind Of Information T Car Loans Bad Credit Car Loan Loan

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

Follow Financialfitclub Credit Creditrepair Creditscore Creditrestoration Financialfreedom Debt Realestate Credit Repair Credit Education Good Credit

Today We Take A Look At The Difference Good Credit Vs Bad Credit Can Make Bad Credit Can Still Get You Appro Good Credit Credit Repair Credit Repair Services