cayman islands tax residency

This may be relevant or desirable for. Last updated 18 August 2022 When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa country without direct taxthere are certain rules.

Cayman Islands A True Tax Haven

The Cayman Islands Cayman Islands Residency-by-Investment.

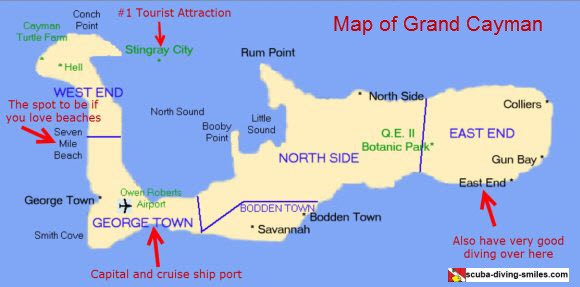

. In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. The Cayman Islands a British Overseas Territory is located a short 70-minute flight away from Miami. Through the Cayman Islands Golden Visa you could potentially lower your annual tax bill by.

Corporate - Corporate residence. Additionally one of the. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country.

Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. Certificate of Permanent Residence for Persons of Independent Means. When contemplating the Cayman Islands Tax Residency Programme there are TWO real estate Residency-by-Investment options which we will discuss here.

Cayman Islands For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. There are no corporate income capital gains or other direct taxes imposed on corporations in Cayman Islands. They have no income tax no property taxes no capital gains taxes.

Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate. The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue. Permanent Residence Based on Eight Years Residence For persons of independent means Any person who has.

Not only does it allow for tax-efficient residency but. When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence. The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands.

The residency by investment program in the Cayman Islands is one of the most popular ways to gain residency in an offshore jurisdiction. Therefore corporate residency is also not relevant in this. In the Cayman Islands there is no income tax company tax or property tax.

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

Chabad House Cayman Islands As A Thriving Financial Center And Tax Neutral Jurisdiction The Cayman Islands Has Long Been An Attractive Option For Doing Business And Establishing Residency In The Wake Of

Cayman Islands Residency By Investment Faq Investment Migration Insider

Cayman Islands Tax Efficient Residency Visa

Cayman Islands Non Resident Company

Cayman Islands Residency By Investment Tax Efficient Residency

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Cayman Islands Permanent Residency Program Citizenship By Investment Journal

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

How Does Permanent Residency Work In The Cayman Islands

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Non Resident Company Formation And Benefits

Cayman Islands Caribbean Journal

Cayman Islands Golden Visa Best Citizenships

Employer Of Record Eor In Cayman Islands Rivermate

The Cayman Islands A Jurisdiction Of Choice For High Net Worth Individuals And Family Offices Impact Wealth